Content

Cost of goods sold is an expense account, which should also be increased by the amount the leather journals cost you. Record accounting debits and credits for each business transaction. When you record debits and credits, make two or more entries for every transaction. The next month, Sal makes a payment of $100 toward the loan, $80 of which goes toward the loan principal and $20 toward interest. To record the payment, Sal makes a debit entry to the Loans Payable account , a debit entry to Interest Expense , and a credit entry to his cash account.

Usually, a General Ledger has Subsidiary Ledgers, which contain the respective details of the account. For instance, an accounts receivable General Ledger will have Subsidiary Ledgers that contain information about the amount that each customer owes. A General Ledger for Inventory will contain Subsidiary Ledgers that will show the breakdown between raw materials, work-in-progress, and finished goods.

Debits and Credits for T Accounts

All business transactions have a monetary impact on the financial statements and the bottom line of an organization. If cash is received immediately, then the debit side of the entry would be cash instead of accounts receivable. — Now let’s take the same example as above except let’s assume Bob paid for the truck by taking out a loan. Bob’s vehicle account would still increase by $5,000, but his cash would not decrease because he is paying with a loan.

How To Manage A Business Loan – Bankrate.com

How To Manage A Business Loan.

Posted: Fri, 17 Feb 2023 16:44:43 GMT [source]

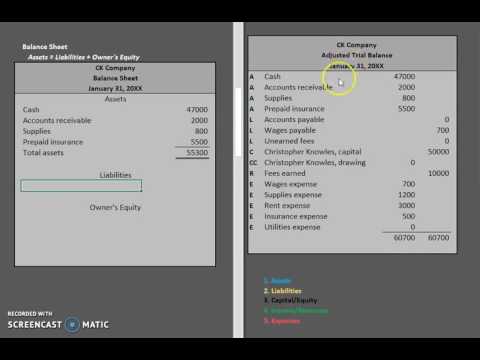

Each transaction must have a debit entry and a credit entry and the total of the debit entries must equal the total of the credit entries. In this journal entry, cash is increased and accounts receivable credited . To keep a company’s financial data organized, accountants developed a system that sorts transactions into records called accounts. When a company’s accounting system is set up, the accounts most likely to be affected by the company’s transactions are identified and listed out. Depending on the size of a company and the complexity of its business operations, the chart of accounts may list as few as thirty accounts or as many as thousands. A company has the flexibility of tailoring its chart of accounts to best meet its needs.

Debits and Credits Example: Loan Repayment

In this way, the system provides for maximum accuracy and consistency in the Debits And Credits’s accounting records. The process is further explained by the nature of the account in which debits and credits are used. To elaborate, some accounts carry a debit, or positive balance, while others carry a credit, or negative balance. The effect of the debit and credit journal entries will depend on which type of the two accounts they are entered. Properly establishing your chart of accounts in accounting software, and diligently noting which account a debit or credit belongs to, enables the program to apply the debits and credits properly. Assets and expense accounts are increased with a debit and decreased with a credit. Meanwhile, liabilities, revenue, and equity are decreased with debit and increased with credit.

- This is visually represented in Accounting Game – Debits and Credits as a big green T.

- Every journal entry is posted to its respective T Account, on the correct side, by the correct amount.

- This can be a bit confusing, since the value of the account is going up, but we refer to it as a credit.

- Save time, reduce risk, and create capacity to support your organization’s strategic objectives.

- For example, you might have an account that details the value of all the equipment your business owns, and another could show all the cash you have in your business bank account.

- In this system, all of your business is organized into distinct accounts that represent different areas of your business.

- If you will notice, debit accounts are always shown on the left side of the accounting equation while credit accounts are shown on the right side.

Her work has appeared in Business Insider, Forbes, and The New York Times, and on LendingTree, Credit Karma, and Discover, among others. Credits always appear on the right side of an accounting ledger.

Credit and debit accounts

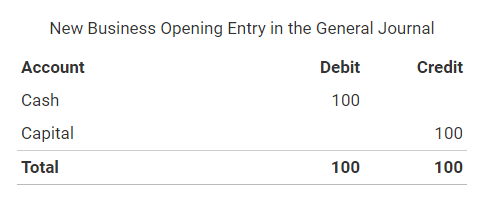

Debits and Credits are simply accounting terminologies that can be traced back hundreds of years, which are still used in today’s double-entry accounting system. Debits and credits are used to monitor incoming and outgoing money in your business account. In a simple system, a debit is money going out of the account, whereas a credit is money coming in.

When you’re working with a company’s general ledger, it’s important to keep the equation in balance. When you debit an account, you must also credit another account. If you’re using the accrual method of accounting for inventory, when you enter a journal entry, you have to keep these two sides in balance by matching debits to credits. If the two sides of the equation are out of balance, then you have an error or omission in your records.

Does Issuing Common Stock for the Purchase of a Company Affect Retained Earnings?

A COA lists all https://personal-accounting.org/ accounts in the general ledger for a business, and business owners can use this organizational tool to perform a financial analysis. Understanding accounting basics is critical for any business owner. Read on to understand debit and credit accounting, the concept of double-entry accounting and a few accounting best practices. Now that you know about the difference between debit and credit and the types of accounts they can impact, let’s look at a few debit and credit examples. To decrease an account you do the opposite of what was done to increase the account. T accounts are simply graphic representations of a ledger account. Every transaction in double-entry accounting is recorded with at lease one debit and credit.

The double-entry system requires both debit and a credit entries. When these two items balance out — or equal zero — on your balance sheet, your books are balanced.

However, most businesses use a double-entry system for accounting. This can create some confusion for inexperienced business owners, who see the same funds used as a credit in one area but a debit in the other. This entry increases inventory , and increases accounts payable .

Your Guide to Starting a Business The tools and resources you need to get your new business idea off the ground. Assets are the things you own, this can be the company premises, company bank balance, or even the company truck. Write down the name of the account or related accounts that are affected by the transaction. Amanda Jackson has expertise in personal finance, investing, and social services. She is a library professional, transcriptionist, editor, and fact-checker.